December 31, 2025: My portoflio has gained 63% for the year after expenses, I have zero debt, and no taxes owed for 2024. 2025 taxes have not yet been deducted and most of my gains are unrealized gains still. I would guess I may owe $20K-$25K for 2025 capital gains.

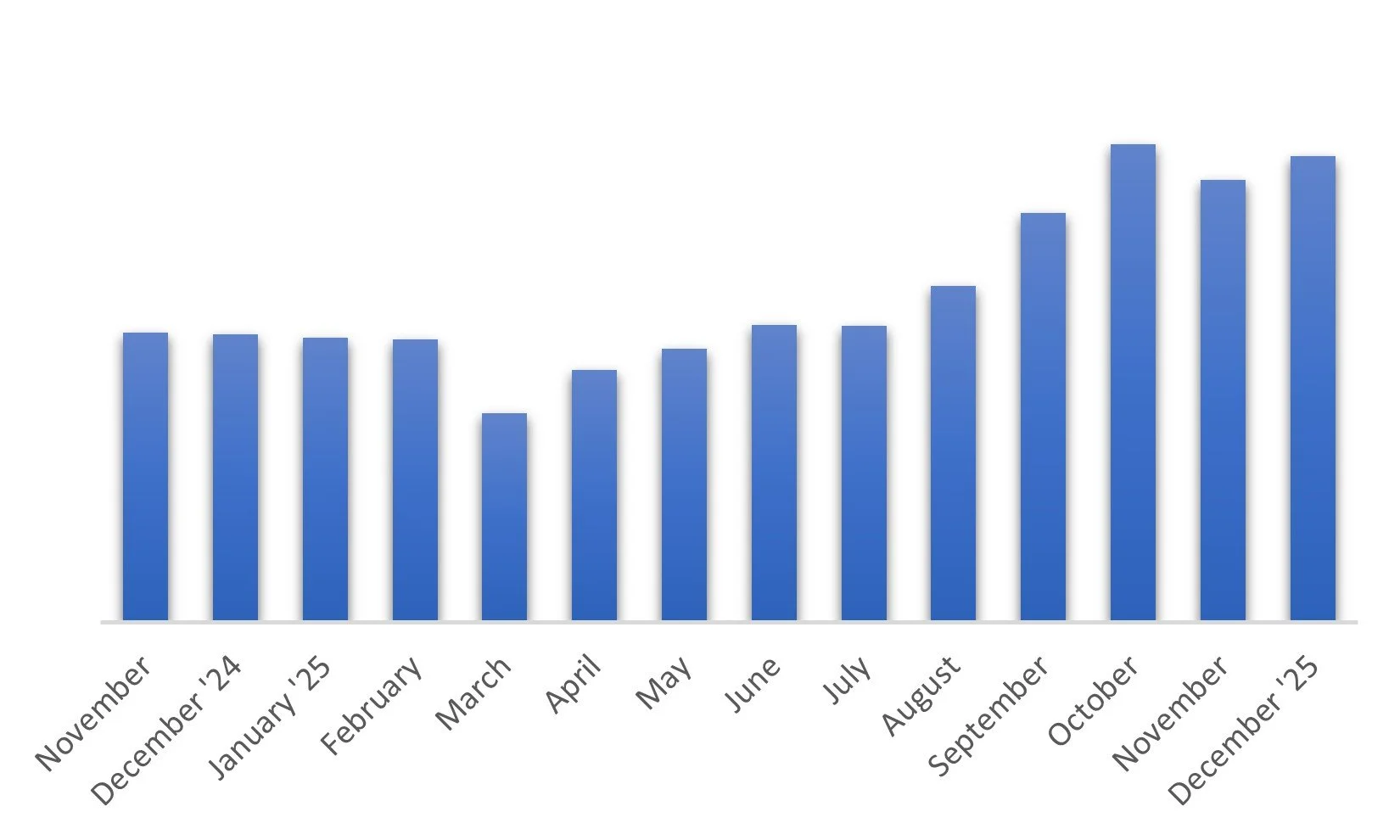

The graph shows my base (the cash I have for investment) after all living expenses and is updated at month end. It reflects the deduction of advance rent set aside, typically 12 months, as well as any credit card debt. These deductions provide a more accurate representation of my true base after all living expenses. It does not, however, include capital gains tax I may owe, which will be deducted at the end of each year or whenever possible. My goals are to consistently grow this figure on an annual basis, maintain zero or near-zero debt, improve the consistency of my investing/trading habits and execution, and take full advantage of compounding over time.

This Weekly Update: January 16, 2026

Executed trades this week: Sold PGY for higher conviction bets, adding to CNVIF and initating TENX.

News this week: TGTX reported preliminary numbers for the quarter and full year and issued guidance. Strong sales and growth and profitability. Stock undervalued by 50% as is with no further developments are guidance beats.

GLSI with yet more open market stock purchases at even higher prices.

VLTLF is redomiciling headquarters to Texas from Canada. This to align with plans for uplisting plans along with plans to be awarded grants/investment from US govt. for building out critical minerals supply chains.

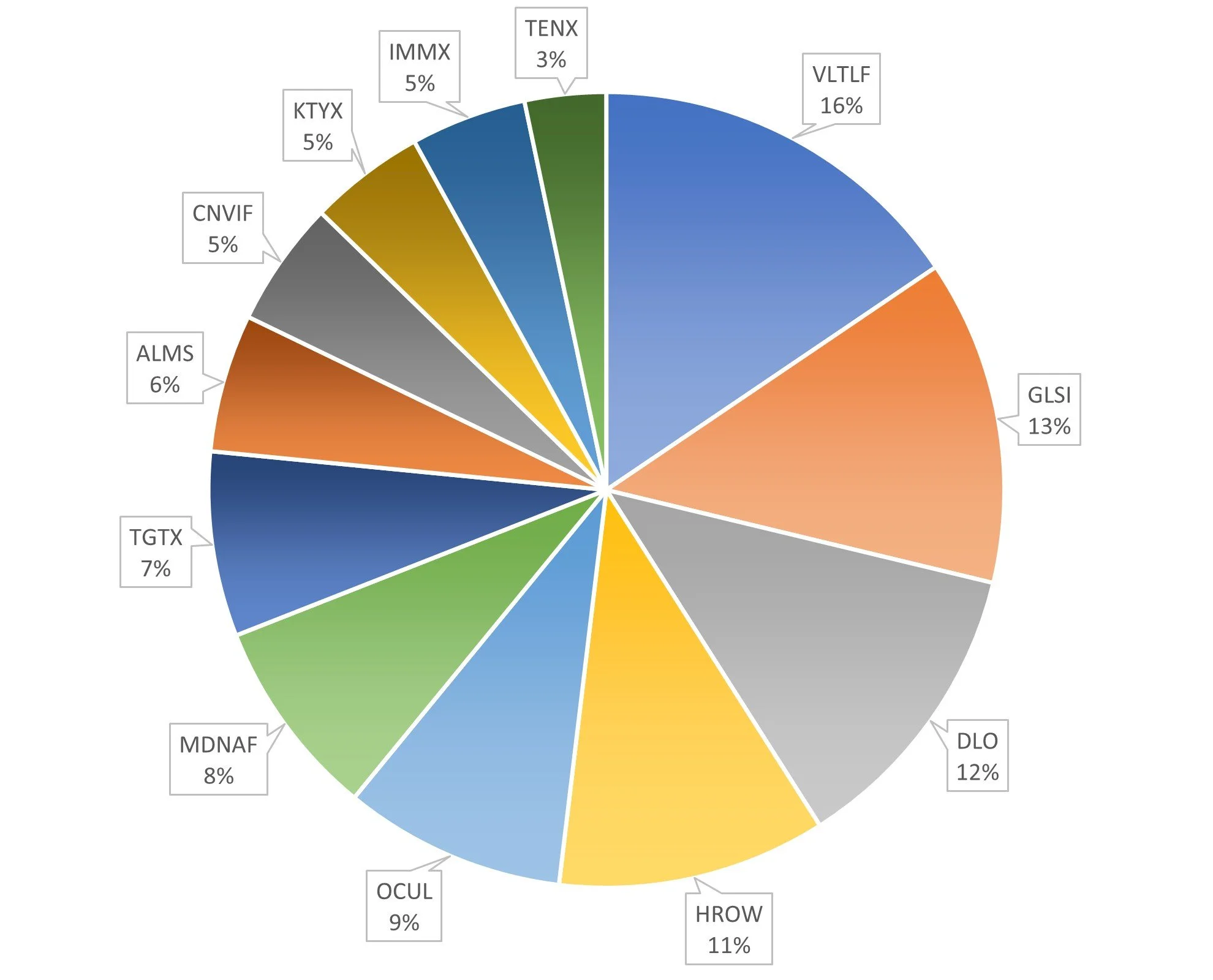

Number of holdings: 12

Unrealized Gains/Losses today: VLTLF +409.44%; GLSI +118.51%; DLO -0.99%; HROW +35.84%; OCUL -8.39%; MDNAF -33.26%; TGTX -0.33%; ALMS +45.24%; CNVIF -19.62%; KYTX +3.72%; IMMX -6.33%; TENX +3.11%

Next Update: January 23

On mobile devices the best view of the table below is likely horizontal orientation.

| Ticker | Company | Reason I'm Buying |

|---|---|---|

| DLO | DLocal Ltd. | Long-term holder and have traded DLO twice this year profitably. DLocal is the undisputed in cross border payments, particularly in emerging markets. They're growing and have a long runway. TPV is popping, revenue is growing rapidly, EPS continues to rise. The take rate is declining as expected and profit margins with it. While typical for this type of company, the market doesn't know yet how to value DLO given these dynamics. I think if the EPS continues to rise and FCF as well (though unlikely in sync short-term) over the long-term as I expect, this will continue to be very attractive. DLocal is one of the lowest risk investments in the market, in my opinion. Solid management executing flawlessly and consistently. Integrations and major partnerships are announced on a rolling basis.

12/27/25: I am simply looking to see continued execution by this company and CEO as described here. The Q4 report and guidance for 2026 at the end of February should continue to tell the same story. |

| HROW | Harrow Inc. | New position, looking to be a long-term holder. Harrow is undervalued as an upcoming fastest growing ophthalmology company. They have the infrastructure, leadership, and execution to warrant a higher quarter over quarter growth rate than the market gives them credit for right now. A growth rate that should last for the next 6-8 quarters and beyond.

12/27/25: Script data look strong in Q4 and while Q1 is seasonally the slowest, this is also when payors kick in for the first time for Harrow. Next year should be great for the Company and stock price. I am looking to see continued execution. |

| VLTLF | LiberyStream Infrastructure | Long-term holder. Previously Volt Lithium, LibertyStream is able to extract lithium from oil field brine, a waste product of oil drilling. This provides the opportunity for a second stream of income for oil companies and water treatment companies focused on extracting valuable resources from oilfield brine like LiberyStream's partner Wellspring Hydro. It also serves as a domestic supply of lithium for the US. The company has just recently completed the purchase of a small $2.5M chemistry set to convert their lithium chloride eluate to lithium carbonate, the finished product for the end user's requirements. We are waiting on JV announcement most likely with an oil company. The nearest competitor to VLTLF will require $1.5B and some years to construct their prototype whereas VLTLF is able to get going for just $20M and scale. JV announcement could be imminent.

12/27/25: Recent non-brokered private placement gives runway for producing samples of lithium carbonate to send potential customers for testing. Offtake agreements to follow. Waiting now. In the meantime, commodity prices for LC are rising. |

| MDNAF | Medicenna Therapeutics Inc. | Long-term holder and have traded profitably once before. Medicenna is in Phase 1/2 for their engineered IL2 in multiple cancer types both as a monotherapy and in combination with Keytruda. Some background knokwledge of the IL2 space is important to understand here. Pharma poured many $billions into IL2 because of the promise of stimulating the body's own natural immune response to fight cancer but toxicity levels were always too high. It has taken many years for the IL2 space to reemerge thanks to engineered versions, like MDNA11. MDNA11 selectively activates the "gas pedal" of the immune system (CD8+/NK cells) while removing the "brake" (Tregs) and the "danger" (Vascular Leak). It is still early but monotherapy results have been excellent and recent combination data with Keytruda - which would work with MDNA11 by then showing the immune system which cells are the cancer cells - shows promise. I believe this is an excellent candidate for large pharma to acquire. Recent deals and acquisitions in the space are in the $1-2B range and so far MDNA11 is proving it is the best in class. There are other drugs in the pipeline, but this is the one to watch.

12/27/25: The stock price will be flat or down without more developments but I am keeping attention on the data. Funds need to step in and provide funding to advance the Company or the eventual buy-out or deal with Merck I'm looking for would need to happen. Anything is possible now. Funds will run out mid-2026 and I'm not expecting more significant data on MDNA11 until at least mid-2026. |

| OCUL | Ocular Therapeutix Inc. | First trade recently initiated. Ocular is about to announce Phase 3 results in wet AMD. This is widely expected to be successful in the biotech investor community, and I believe the market will soon be forced to rerate and factor in the massive TAM and peak sales estimates between 3-5B. We could see a 100% move or more on this data and expectations for approval. The market is beginning to factor in and will start to give more value to the rest of their pipeline after late-stage trials begin for those (soon). Interestingly, the C-suite is also incentivized to get the stock over $30/sh. On 12/5/25, the Company filed an 8-K stating they will be filing in 2025 after the first Phase 3 is completed instead of waiting until the second Phase 3 completion in 2026 per new FDA protocols. Good news! |

| TGTX | TG Therapeutics, Inc. | Second trade for me. First was profitable, around 30% gain. The stock has since fallen near where I'd previously bought it at 27+, now 30+/share. Briumvi is FDA approved for adults with relapsing forms of multiple sclerosis (MS), including clinically isolated syndrome (CIS), relapsing-remitting MS (RRMS), and active secondary progressive MS (SPMS). The relapse rate is something like once every 90 years. The sales growth has been steady and is expected to continue. Once patients are on Briumvi, they stay on so what is almost the equivalent of recurring revenue and profits here are massive in time. By 2030, likely looking at close to $2.5B annual sales. Current trials are for a modified dose regimen for easier administration in-clinic and a subcutaneous at-home administration trial, the latter of which is the most market expanding opportunity and data will be available on that sometime in 2027. The Company is profitable and there is little chance of further dilution. |

| TENX | Tenax Therapeutics Inc. | Tenax Therapeutics ($TENX) is a high-conviction biotech play focused on TNX-103 (oral levosimendan), a potential first-in-class treatment for Pulmonary Hypertension in Heart Failure with Preserved Ejection Fraction (PH-HFpEF). The investment thesis is built on a massive, zero-competition market of over 1.5 million patients and a significantly derisked Phase 3 "LEVEL" trial. A December 2025 statistical assessment confirmed the trial is over 90% powered to succeed without needing to increase the patient count, a rare and bullish signal for investors. With approximately $105 million in cash providing a runway into 2027, the company is well-capitalized to reach its critical clinical goals. Looking ahead, 2026 is the definitive "catalyst year" for the stock. Tenax expects to complete enrollment for the 230-patient LEVEL study in the first half of 2026, followed by the release of Phase 3 topline data in the second half of 2026. Simultaneously, the company is advancing its larger, global LEVEL-2 study, which initiated in late 2025 to build the robust safety database required for FDA and global regulatory filings. Positive topline data later this year would likely trigger a significant rerating of the stock, as $TENX remains the only company with a treatment currently in Phase 3 for this specific, underserved indication. |

| GLSI | Greenwich LifeSciences | Long-term holder. Greenwich is in registrational Phase 3 for preventing breast cancer recurrence. Huge success in previous trial. 14 "events" needed to trigger the first interim analysis. Estimates from different AI tools put this somewhere between second half 2026 and second half 2027. I don't want to miss it. This could be a 1,000% gainer from here on positive results. CEO share purchases are consistent and high. A lot of skin in the game. On 12/5/2025, the Company announced they have enrolled 1,000 patients in either of the two HLA groups and will continue enrollment. There are multiple reasons why they cited. The adaptive protocol amendment, guided by the Steering Committee and emerging data on GP2 efficacy across HLA types, allows ongoing enrollment to generate more events for multiple interim analyses, refine cohort sizes, and support broader labeling claims (e.g., all HER2+ patients) while leveraging high screening rates (~150/quarter). This enhances regulatory flexibility and commercial potential without altering the primary endpoint power. The does not increase the time to interim analysis for which 14 "events" is required. An event here is defined as invasive breast cancer recurrence. |

| IMMX | Immix Biopharma Inc. | First trade here for me. Market Monopoly: $IMMX is on track to deliver the first FDA-approved CAR-T for relapsed/refractory AL Amyloidosis—a "blue ocean" market with no current approved therapies and a potential $3B+ opportunity. Best-in-Class Efficacy: Recent Phase 2 data (ASH 2025) showed a 75% Complete Response (CR) rate, which is projected to reach 95% based on current bone marrow markers. This dwarfs the <10% response rates of current salvage therapies. The "Outpatient" Advantage: Unlike existing CAR-Ts that require intensive hospital stays, $IMMX's lead asset (NXC-201) has shown zero neurotoxicity and ultra-short (1-day) side effects. This allows for outpatient administration, making it cheaper for insurers and more accessible to the 95% of hospitals that can't currently handle "toxic" cell therapies. Near-Term Catalyst: The company recently raised $100M to fund its 2026 BLA (Biologics License Application) submission. With a cash runway into 2027 and a clear regulatory path (RMAT designation), the 2026 approval is the primary value-unlock. Autoimmune Optionality: If the safety profile holds, NXC-201 is the perfect candidate to pivot into massive markets like Lupus or Myasthenia Gravis, where safety is the #1 barrier to entry. |

| ALMS | Alumis, Inc. | First trade here for me. Pivotal Phase 3 Win: On January 6, 2026, envudeucitinib met all primary and secondary endpoints in the ONWARD trials for plaque psoriasis. With 74% of patients hitting PASI 75 and 40%+ reaching total skin clearance (PASI 100) at 24 weeks, it rivals the efficacy of injectables in a daily pill. Safety Advantage: Unlike its main competitor (Sotyktu), ALMS’s drug shows a cleaner safety profile with no new safety signals and a 1-day side-effect duration. Its "digital-filter" design minimizes the toxicities usually associated with this drug class. Fully Capitalized: The company just closed a $345 million upsized funding round (Jan 9, 2026) at $17/share. This eliminates near-term dilution risk and provides the cash runway to submit its NDA in late 2026 and fund a global launch. "Pipeline-in-a-Pill": The psoriasis win de-risks the platform for much larger markets, including Lupus (Phase 2b data due Q3 2026) and neuroinflammation. NOTE: I do not know that I am holding through the Lupus data yet. Lupus is commonly referred to the graveyard of clinical stage drugs due to high placebo responses and clumsy tools for measuring outcomes. |

| KYTX | Kyverna Therapeutics, Inc. | First trade here for me. KYTX is a "first-mover" play on the transition of CAR-T therapy from oncology into massive autoimmune markets, specifically targeting neuroimmunology. Pivotal Success in SPS: On December 15, 2025, Kyverna reported positive Phase 2 registrational data for its lead asset, miv-cel (KYV-101), in Stiff Person Syndrome (SPS). The trial met its primary endpoint with a 46% median improvement in mobility (timed 25-foot walk), significantly exceeding the 20% clinical benchmark. The "Safety Shield": Miv-cel is designed to be safer than oncology CAR-Ts. Across all indications (SPS, Myasthenia Gravis, Lupus), it has shown zero high-grade ICANS (neurotoxicity) and manageable CRS. This safety profile is essential for treating non-cancer patients who cannot tolerate high-toxicity profiles. Recent Funding & Runway: Following the SPS data, Kyverna closed a $100 million public offering (Dec 17, 2025). Combined with a $150 million debt facility secured in late 2025, the company has a cash runway into 2027, fully funding its operations through its next major regulatory hurdles. Imminent BLA Catalyst: Kyverna is on track to submit its first BLA in H1 2026 for SPS. If approved, it would likely be the first-ever FDA-approved CAR-T for an autoimmune disease, establishing a dominant market position. Broad Pipeline Upside: Success in SPS de-risks the platform for its other ongoing registrational trial in Myasthenia Gravis (Phase 3) and its expansion into Multiple Sclerosis and Lupus Nephritis. |

| CNVIF | Conavi Medical Corp. | First trade here for me. CNVIF is a "disruptive med-tech" play on the only imaging system capable of combining the two gold standards of coronary diagnostics into a single device. The "Hybrid" Monopoly: Conavi’s Novasight Hybrid System is the first and only platform to combine IVUS (ultrasound) and OCT (optical imaging) on a single catheter. This gives cardiologists a "super-view" of arteries that neither technology can provide alone. Imminent FDA Catalyst: In September 2025, the company submitted its next-generation system for FDA 510(k) clearance. A formal U.S. commercial launch is anticipated for H1 2026, which serves as the primary near-term price driver. Guideline Tailwinds: Global medical guidelines (ACC/AHA/ESC) recently upgraded intravascular imaging to a Class 1A recommendation (the highest level). This mandate is forcing hospitals to adopt new imaging tech, creating a massive organic growth wave for $CNVIF. Freshly Capitalized: Following a $20M institutional raise in 2025 and an ongoing January 2026 public offering, the company has significantly de-risked its balance sheet to fund the upcoming U.S. sales force and manufacturing scale-up. Rapid Revenue Growth: Revenue grew from $2.2M to $9.1M in the last fiscal year (+300%). Analysts project revenue to continue growing at over 50% annually as the U.S. launch commences. |